A sophisticated WhatsApp job scam is tricking thousands globally, including job seekers in the UK, India, and beyond. These scams promise lucrative work-from-home roles, create fake dashboards, and pressure victims to send money via crypto wallets — but in reality, the job and earnings are entirely fake.

A sophisticated WhatsApp job scam is tricking thousands globally, including job seekers in the UK, India, and beyond. These scams promise lucrative work-from-home roles, create fake dashboards, and pressure victims to send money via crypto wallets — but in reality, the job and earnings are entirely fake.

A sophisticated WhatsApp job scam is tricking thousands globally, including job seekers in the UK, India, and beyond. These scams promise lucrative work-from-home roles, create fake dashboards, and pressure victims to send money via crypto wallets — but in reality, the job and earnings are entirely fake.

A sophisticated WhatsApp job scam is tricking thousands globally, including job seekers in the UK, India, and beyond. These scams promise lucrative work-from-home roles, create fake dashboards, and pressure victims to send money via crypto wallets — but in reality, the job and earnings are entirely fake.

A sophisticated WhatsApp job scam is tricking thousands globally, including job seekers in the UK, India, and beyond. These scams promise lucrative work-from-home roles, create fake dashboards, and pressure victims to send money via crypto wallets — but in reality, the job and earnings are entirely fake.

A sophisticated WhatsApp job scam is tricking thousands globally, including job seekers in the UK, India, and beyond. These scams promise lucrative work-from-home roles, create fake dashboards, and pressure victims to send money via crypto wallets — but in reality, the job and earnings are entirely fake.

A sophisticated WhatsApp job scam is tricking thousands globally, including job seekers in the UK, India, and beyond. These scams promise lucrative work-from-home roles, create fake dashboards, and pressure victims to send money via crypto wallets — but in reality, the job and earnings are entirely fake.

Job scams are increasing as more people look for remote and flexible work. Scammers pretend to be recruiters and lure victims with lucrative job offers — but their real goal is to steal money or personal information. This blog helps you understand how job scams work and how to stay safe.

Job scams are increasing as more people look for remote and flexible work. Scammers pretend to be recruiters and lure victims with lucrative job offers — but their real goal is to steal money or personal information. This blog helps you understand how job scams work and how to stay safe.

Job scams are increasing as more people look for remote and flexible work. Scammers pretend to be recruiters and lure victims with lucrative job offers — but their real goal is to steal money or personal information. This blog helps you understand how job scams work and how to stay safe.

Job scams are increasing as more people look for remote and flexible work. Scammers pretend to be recruiters and lure victims with lucrative job offers — but their real goal is to steal money or personal information. This blog helps you understand how job scams work and how to stay safe.

Spammers use blogs to manipulate search rankings and spread low-quality content. This study reveals how their behavior can be detected using live search data.

Job scams are increasing as more people look for remote and flexible work. Scammers pretend to be recruiters and lure victims with lucrative job offers — but their real goal is to steal money or personal information. This blog helps you understand how job scams work and how to stay safe.

Job scams are increasing as more people look for remote and flexible work. Scammers pretend to be recruiters and lure victims with lucrative job offers — but their real goal is to steal money or personal information. This blog helps you understand how job scams work and how to stay safe.

Spammers use blogs to manipulate search rankings and spread low-quality content. This study reveals how their behavior can be detected using live search data.

Spammers use blogs to manipulate search rankings and spread low-quality content. This study reveals how their behavior can be detected using live search data.

Spammers use blogs to manipulate search rankings and spread low-quality content. This study reveals how their behavior can be detected using live search data.

Spammers use blogs to manipulate search rankings and spread low-quality content. This study reveals how their behavior can be detected using live search data.

Spammers use blogs to manipulate search rankings and spread low-quality content. This study reveals how their behavior can be detected using live search data.

Job scams are increasing as more people look for remote and flexible work. Scammers pretend to be recruiters and lure victims with lucrative job offers — but their real goal is to steal money or personal information. This blog helps you understand how job scams work and how to stay safe.

The “Grandparent Scam” is a deceptive fraud where scammers impersonate a grandchild or relative in distress. These fraudsters use emotional manipulation, fake emergencies, and urgency to trick elderly individuals into sending money. With the rise of social media and AI tools, this scam is becoming more sophisticated and widespread in India.

The “Grandparent Scam” is a deceptive fraud where scammers impersonate a grandchild or relative in distress. These fraudsters use emotional manipulation, fake emergencies, and urgency to trick elderly individuals into sending money. With the rise of social media and AI tools, this scam is becoming more sophisticated and widespread in India.

The “Grandparent Scam” is a deceptive fraud where scammers impersonate a grandchild or relative in distress. These fraudsters use emotional manipulation, fake emergencies, and urgency to trick elderly individuals into sending money. With the rise of social media and AI tools, this scam is becoming more sophisticated and widespread in India.

The “Grandparent Scam” is a deceptive fraud where scammers impersonate a grandchild or relative in distress. These fraudsters use emotional manipulation, fake emergencies, and urgency to trick elderly individuals into sending money. With the rise of social media and AI tools, this scam is becoming more sophisticated and widespread in India.

The “Grandparent Scam” is a deceptive fraud where scammers impersonate a grandchild or relative in distress. These fraudsters use emotional manipulation, fake emergencies, and urgency to trick elderly individuals into sending money. With the rise of social media and AI tools, this scam is becoming more sophisticated and widespread in India.

The “Grandparent Scam” is a deceptive fraud where scammers impersonate a grandchild or relative in distress. These fraudsters use emotional manipulation, fake emergencies, and urgency to trick elderly individuals into sending money. With the rise of social media and AI tools, this scam is becoming more sophisticated and widespread in India.

The “Grandparent Scam” is a deceptive fraud where scammers impersonate a grandchild or relative in distress. These fraudsters use emotional manipulation, fake emergencies, and urgency to trick elderly individuals into sending money. With the rise of social media and AI tools, this scam is becoming more sophisticated and widespread in India.

The “Grandparent Scam” is a deceptive fraud where scammers impersonate a grandchild or relative in distress. These fraudsters use emotional manipulation, fake emergencies, and urgency to trick elderly individuals into sending money. With the rise of social media and AI tools, this scam is becoming more sophisticated and widespread in India.

The “Grandparent Scam” is a deceptive fraud where scammers impersonate a grandchild or relative in distress. These fraudsters use emotional manipulation, fake emergencies, and urgency to trick elderly individuals into sending money. With the rise of social media and AI tools, this scam is becoming more sophisticated and widespread in India.

The “Grandparent Scam” is a deceptive fraud where scammers impersonate a grandchild or relative in distress. These fraudsters use emotional manipulation, fake emergencies, and urgency to trick elderly individuals into sending money. With the rise of social media and AI tools, this scam is becoming more sophisticated and widespread in India.

The “Grandparent Scam” is a deceptive fraud where scammers impersonate a grandchild or relative in distress. These fraudsters use emotional manipulation, fake emergencies, and urgency to trick elderly individuals into sending money. With the rise of social media and AI tools, this scam is becoming more sophisticated and widespread in India.

The “Grandparent Scam” is a deceptive fraud where scammers impersonate a grandchild or relative in distress. These fraudsters use emotional manipulation, fake emergencies, and urgency to trick elderly individuals into sending money. With the rise of social media and AI tools, this scam is becoming more sophisticated and widespread in India.

The “Grandparent Scam” is a deceptive fraud where scammers impersonate a grandchild or relative in distress. These fraudsters use emotional manipulation, fake emergencies, and urgency to trick elderly individuals into sending money. With the rise of social media and AI tools, this scam is becoming more sophisticated and widespread in India.

Social media is no longer just a space to connect and share — it has become a hunting ground for scammers. From fake brand pages to deceptive investment offers, cybercriminals are exploiting user trust and lack of awareness to steal personal information and hard-earned money.

Social media is no longer just a space to connect and share — it has become a hunting ground for scammers. From fake brand pages to deceptive investment offers, cybercriminals are exploiting user trust and lack of awareness to steal personal information and hard-earned money.

Social media is no longer just a space to connect and share — it has become a hunting ground for scammers. From fake brand pages to deceptive investment offers, cybercriminals are exploiting user trust and lack of awareness to steal personal information and hard-earned money.

Social media is no longer just a space to connect and share — it has become a hunting ground for scammers. From fake brand pages to deceptive investment offers, cybercriminals are exploiting user trust and lack of awareness to steal personal information and hard-earned money.

Social media is no longer just a space to connect and share — it has become a hunting ground for scammers. From fake brand pages to deceptive investment offers, cybercriminals are exploiting user trust and lack of awareness to steal personal information and hard-earned money.

Social media is no longer just a space to connect and share — it has become a hunting ground for scammers. From fake brand pages to deceptive investment offers, cybercriminals are exploiting user trust and lack of awareness to steal personal information and hard-earned money.

Social media is no longer just a space to connect and share — it has become a hunting ground for scammers. From fake brand pages to deceptive investment offers, cybercriminals are exploiting user trust and lack of awareness to steal personal information and hard-earned money.

Scammers pretending to be from your bank contact you via phone, SMS, or WhatsApp claiming your KYC (Know Your Customer) is about to expire. They pressure you into sharing personal details like PAN, Aadhaar, or even OTP codes. Once they have access, they perform unauthorized transactions, drain your bank account, or take over your digital identity.

Scammers pretending to be from your bank contact you via phone, SMS, or WhatsApp claiming your KYC (Know Your Customer) is about to expire. They pressure you into sharing personal details like PAN, Aadhaar, or even OTP codes. Once they have access, they perform unauthorized transactions, drain your bank account, or take over your digital identity.

Scammers pretending to be from your bank contact you via phone, SMS, or WhatsApp claiming your KYC (Know Your Customer) is about to expire. They pressure you into sharing personal details like PAN, Aadhaar, or even OTP codes. Once they have access, they perform unauthorized transactions, drain your bank account, or take over your digital identity.

Scammers pretending to be from your bank contact you via phone, SMS, or WhatsApp claiming your KYC (Know Your Customer) is about to expire. They pressure you into sharing personal details like PAN, Aadhaar, or even OTP codes. Once they have access, they perform unauthorized transactions, drain your bank account, or take over your digital identity.

Scammers pretending to be from your bank contact you via phone, SMS, or WhatsApp claiming your KYC (Know Your Customer) is about to expire. They pressure you into sharing personal details like PAN, Aadhaar, or even OTP codes. Once they have access, they perform unauthorized transactions, drain your bank account, or take over your digital identity.

Scammers pretending to be from your bank contact you via phone, SMS, or WhatsApp claiming your KYC (Know Your Customer) is about to expire. They pressure you into sharing personal details like PAN, Aadhaar, or even OTP codes. Once they have access, they perform unauthorized transactions, drain your bank account, or take over your digital identity.

Scammers pretending to be from your bank contact you via phone, SMS, or WhatsApp claiming your KYC (Know Your Customer) is about to expire. They pressure you into sharing personal details like PAN, Aadhaar, or even OTP codes. Once they have access, they perform unauthorized transactions, drain your bank account, or take over your digital identity.

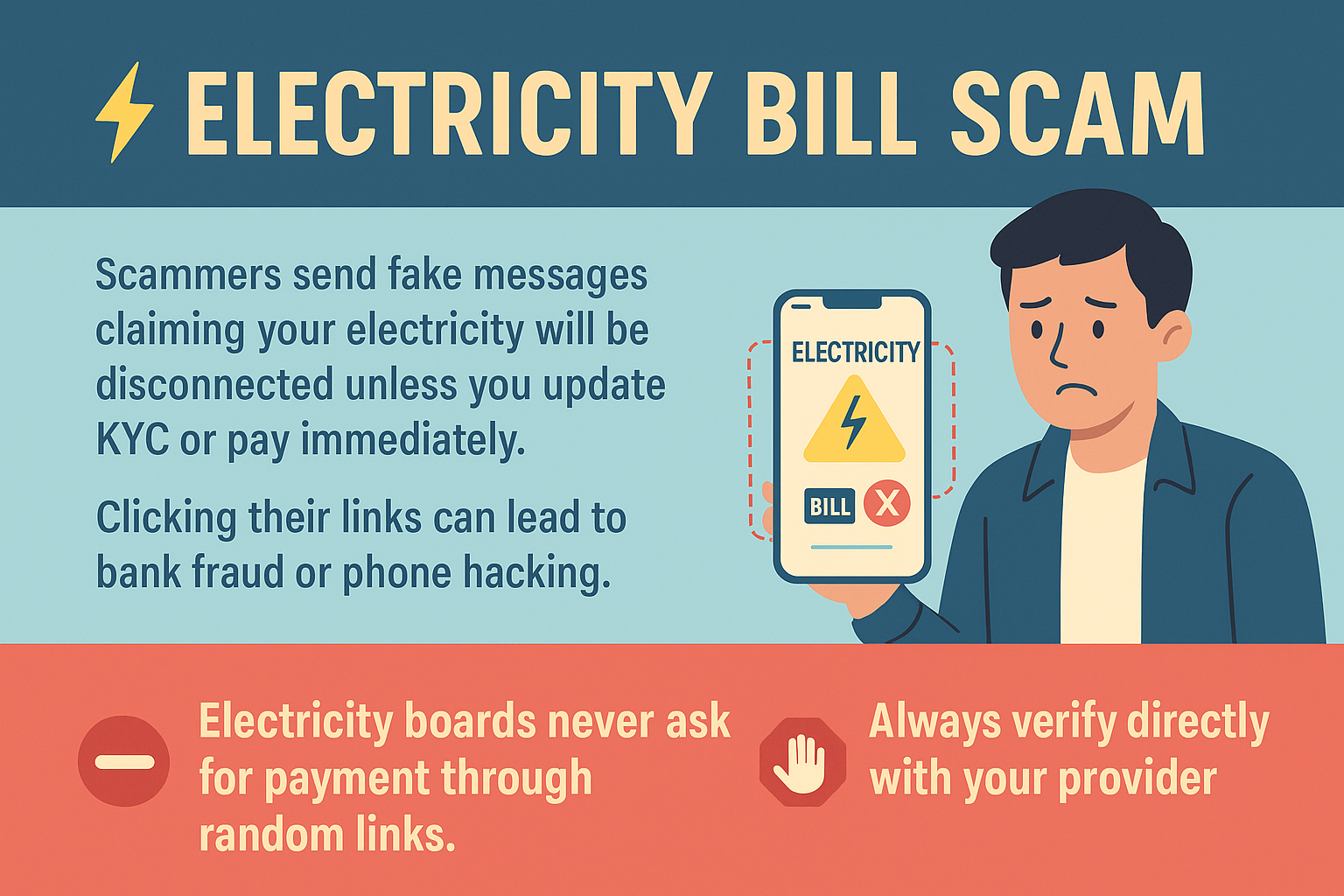

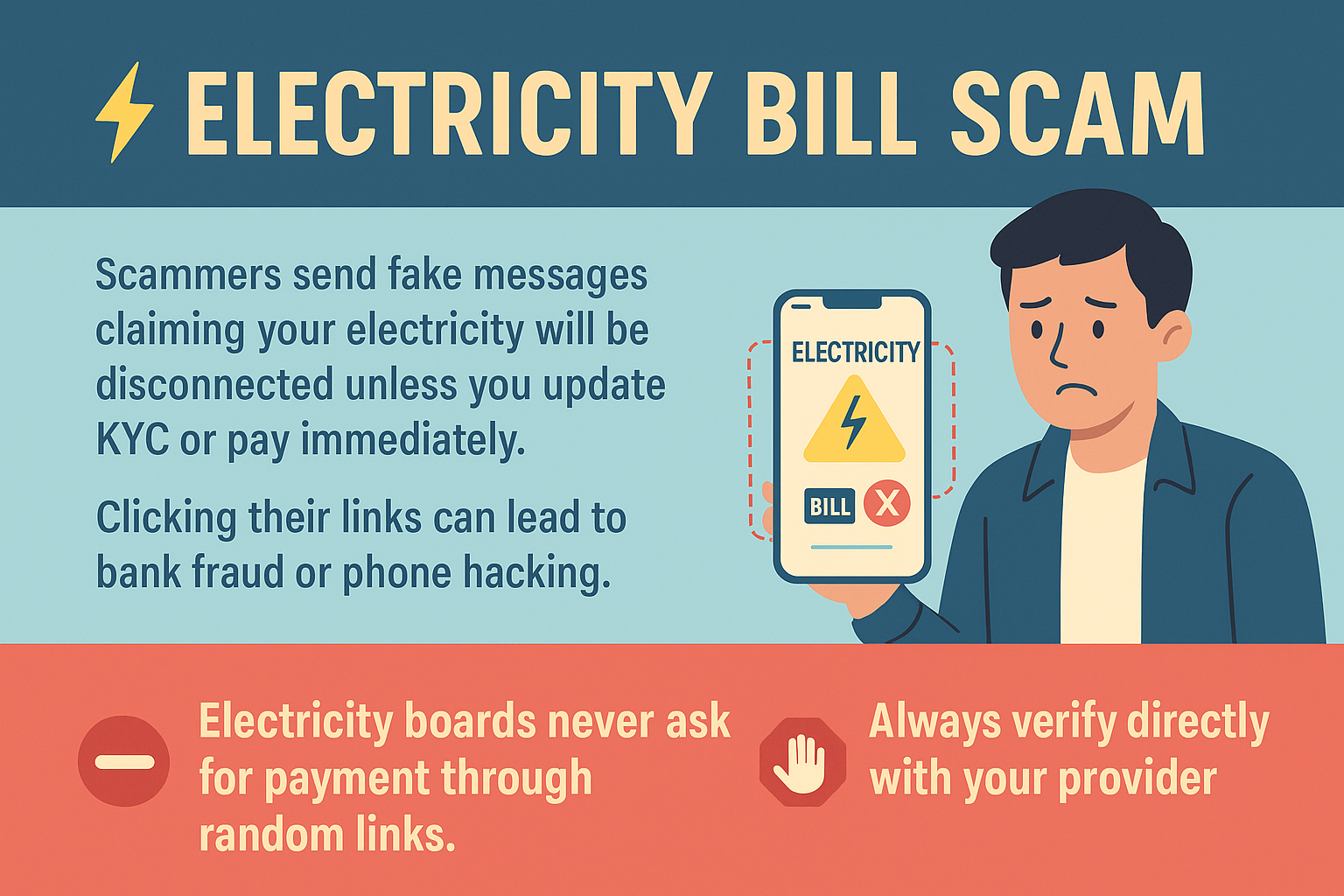

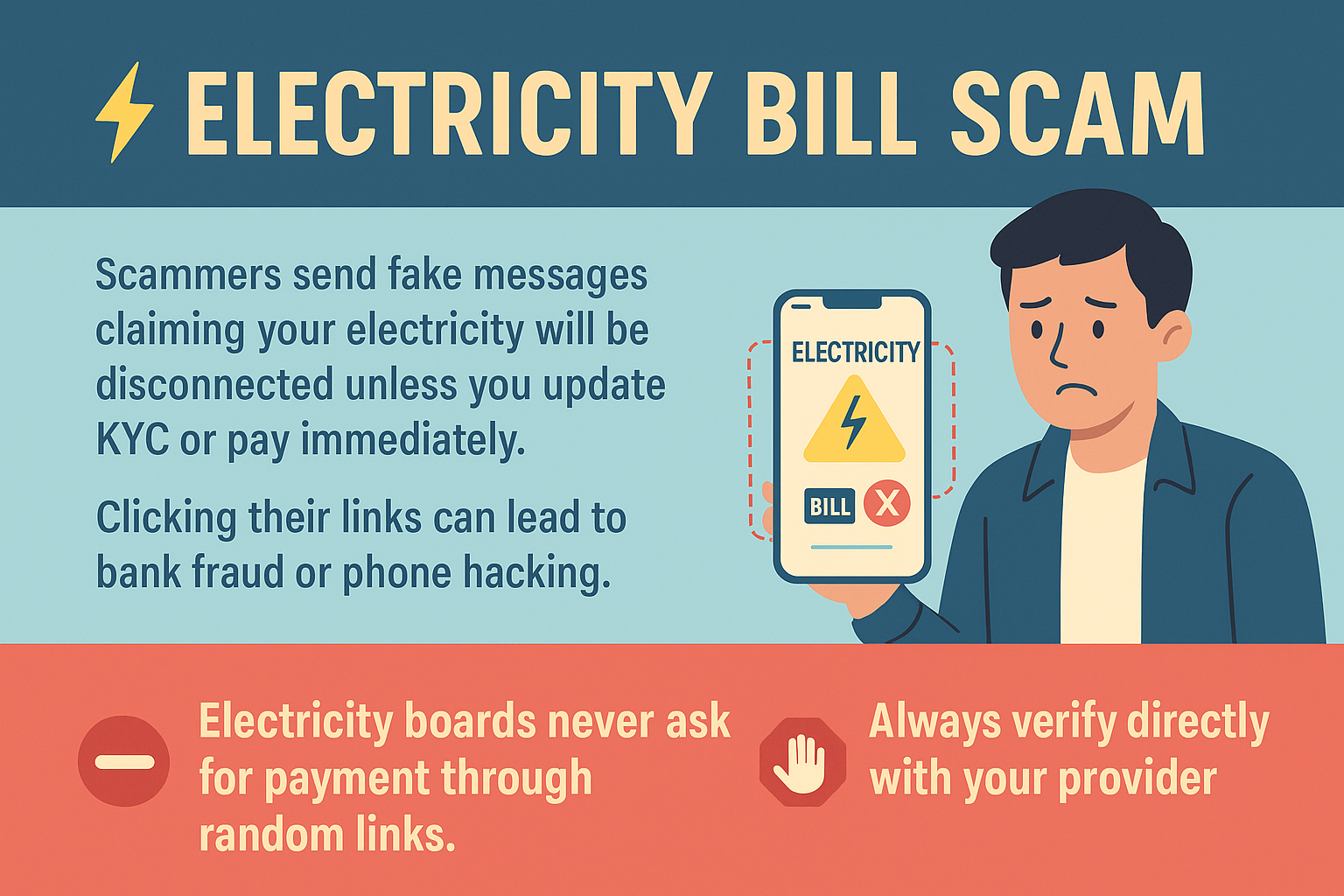

Scammers are impersonating electricity boards and sending fake SMS or WhatsApp messages warning of power disconnection due to unpaid bills. These messages include fake helpline numbers or malicious payment links. Once contacted or clicked, they either trick you into transferring money, install malware on your phone, or steal your banking credentials. Always verify such messages with your official electricity provider and never click unknown links.

Scammers are impersonating electricity boards and sending fake SMS or WhatsApp messages warning of power disconnection due to unpaid bills. These messages include fake helpline numbers or malicious payment links. Once contacted or clicked, they either trick you into transferring money, install malware on your phone, or steal your banking credentials. Always verify such messages with your official electricity provider and never click unknown links.

Scammers are impersonating electricity boards and sending fake SMS or WhatsApp messages warning of power disconnection due to unpaid bills. These messages include fake helpline numbers or malicious payment links. Once contacted or clicked, they either trick you into transferring money, install malware on your phone, or steal your banking credentials. Always verify such messages with your official electricity provider and never click unknown links.

Scammers are impersonating electricity boards and sending fake SMS or WhatsApp messages warning of power disconnection due to unpaid bills. These messages include fake helpline numbers or malicious payment links. Once contacted or clicked, they either trick you into transferring money, install malware on your phone, or steal your banking credentials. Always verify such messages with your official electricity provider and never click unknown links.

Scammers are impersonating electricity boards and sending fake SMS or WhatsApp messages warning of power disconnection due to unpaid bills. These messages include fake helpline numbers or malicious payment links. Once contacted or clicked, they either trick you into transferring money, install malware on your phone, or steal your banking credentials. Always verify such messages with your official electricity provider and never click unknown links.

Scammers are impersonating electricity boards and sending fake SMS or WhatsApp messages warning of power disconnection due to unpaid bills. These messages include fake helpline numbers or malicious payment links. Once contacted or clicked, they either trick you into transferring money, install malware on your phone, or steal your banking credentials. Always verify such messages with your official electricity provider and never click unknown links.

Cybercriminals pose as bank officials, tech support, or government agents and convince you to install screen-sharing apps like AnyDesk, TeamViewer, or QuickSupport. Once granted permission, they control your device remotely and siphon money from your bank accounts, steal sensitive data, or lock you out of your apps. Never share your screen or allow remote access to unknown sources.

Cybercriminals pose as bank officials, tech support, or government agents and convince you to install screen-sharing apps like AnyDesk, TeamViewer, or QuickSupport. Once granted permission, they control your device remotely and siphon money from your bank accounts, steal sensitive data, or lock you out of your apps. Never share your screen or allow remote access to unknown sources.

Cybercriminals pose as bank officials, tech support, or government agents and convince you to install screen-sharing apps like AnyDesk, TeamViewer, or QuickSupport. Once granted permission, they control your device remotely and siphon money from your bank accounts, steal sensitive data, or lock you out of your apps. Never share your screen or allow remote access to unknown sources.

Cybercriminals pose as bank officials, tech support, or government agents and convince you to install screen-sharing apps like AnyDesk, TeamViewer, or QuickSupport. Once granted permission, they control your device remotely and siphon money from your bank accounts, steal sensitive data, or lock you out of your apps. Never share your screen or allow remote access to unknown sources.

Cybercriminals pose as bank officials, tech support, or government agents and convince you to install screen-sharing apps like AnyDesk, TeamViewer, or QuickSupport. Once granted permission, they control your device remotely and siphon money from your bank accounts, steal sensitive data, or lock you out of your apps. Never share your screen or allow remote access to unknown sources.

Cybercriminals pose as bank officials, tech support, or government agents and convince you to install screen-sharing apps like AnyDesk, TeamViewer, or QuickSupport. Once granted permission, they control your device remotely and siphon money from your bank accounts, steal sensitive data, or lock you out of your apps. Never share your screen or allow remote access to unknown sources.

Cybercriminals pose as bank officials, tech support, or government agents and convince you to install screen-sharing apps like AnyDesk, TeamViewer, or QuickSupport. Once granted permission, they control your device remotely and siphon money from your bank accounts, steal sensitive data, or lock you out of your apps. Never share your screen or allow remote access to unknown sources.

Scammers are exploiting job seekers by offering fake employment opportunities through SMS, WhatsApp, and emails. These messages often promise high-paying roles, remote jobs, or international offers. Victims are asked to pay registration or document verification fees, only to be ghosted by the fraudsters afterward. 🚫 Real companies never ask for payment to hire you. Always verify before trusting any job offer.

Scammers are exploiting job seekers by offering fake employment opportunities through SMS, WhatsApp, and emails. These messages often promise high-paying roles, remote jobs, or international offers. Victims are asked to pay registration or document verification fees, only to be ghosted by the fraudsters afterward. 🚫 Real companies never ask for payment to hire you. Always verify before trusting any job offer.

Scammers are exploiting job seekers by offering fake employment opportunities through SMS, WhatsApp, and emails. These messages often promise high-paying roles, remote jobs, or international offers. Victims are asked to pay registration or document verification fees, only to be ghosted by the fraudsters afterward. 🚫 Real companies never ask for payment to hire you. Always verify before trusting any job offer.

Scammers are exploiting job seekers by offering fake employment opportunities through SMS, WhatsApp, and emails. These messages often promise high-paying roles, remote jobs, or international offers. Victims are asked to pay registration or document verification fees, only to be ghosted by the fraudsters afterward. 🚫 Real companies never ask for payment to hire you. Always verify before trusting any job offer.

Scammers are exploiting job seekers by offering fake employment opportunities through SMS, WhatsApp, and emails. These messages often promise high-paying roles, remote jobs, or international offers. Victims are asked to pay registration or document verification fees, only to be ghosted by the fraudsters afterward. 🚫 Real companies never ask for payment to hire you. Always verify before trusting any job offer.

Scammers are exploiting job seekers by offering fake employment opportunities through SMS, WhatsApp, and emails. These messages often promise high-paying roles, remote jobs, or international offers. Victims are asked to pay registration or document verification fees, only to be ghosted by the fraudsters afterward. 🚫 Real companies never ask for payment to hire you. Always verify before trusting any job offer.

Scammers are exploiting job seekers by offering fake employment opportunities through SMS, WhatsApp, and emails. These messages often promise high-paying roles, remote jobs, or international offers. Victims are asked to pay registration or document verification fees, only to be ghosted by the fraudsters afterward. 🚫 Real companies never ask for payment to hire you. Always verify before trusting any job offer.

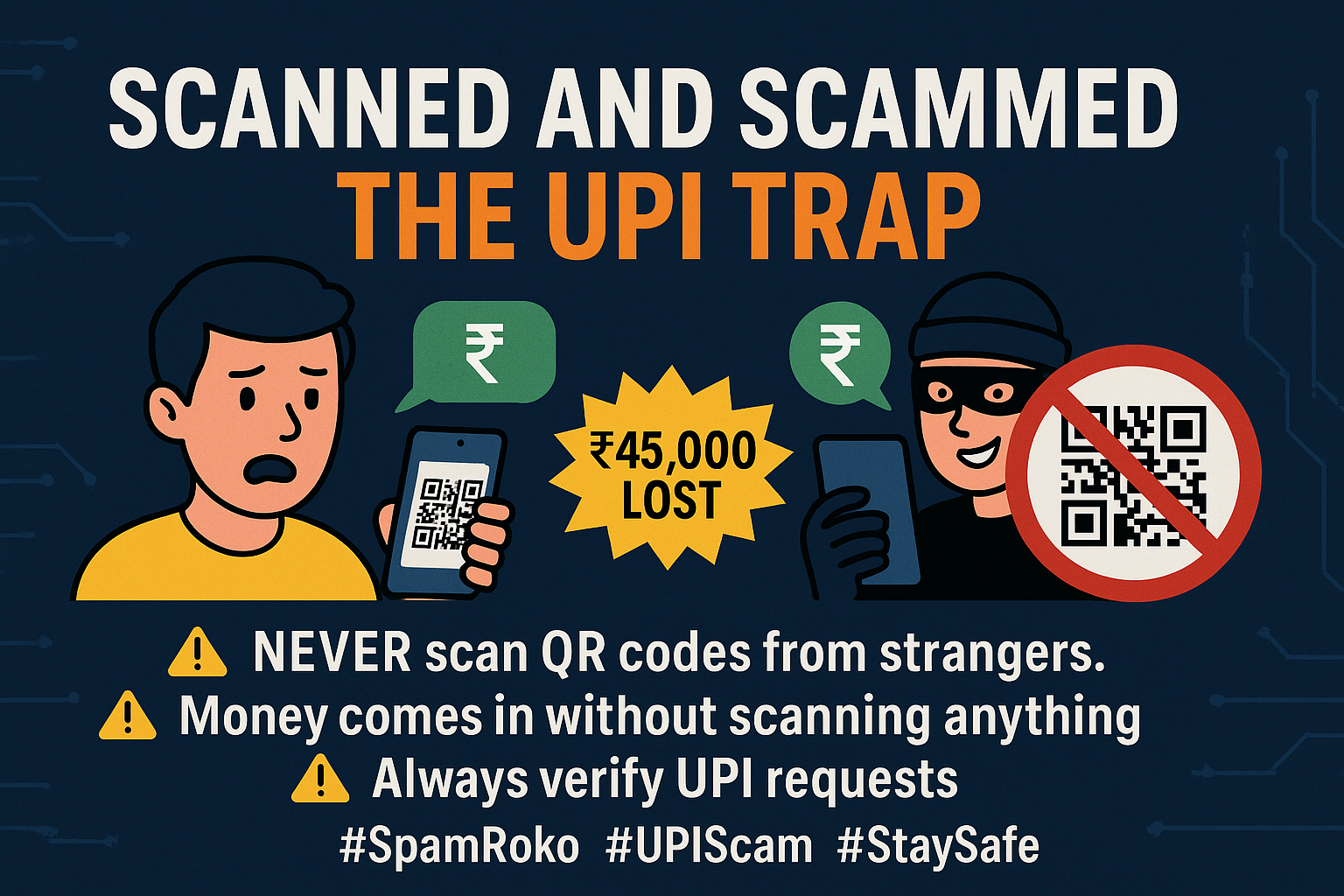

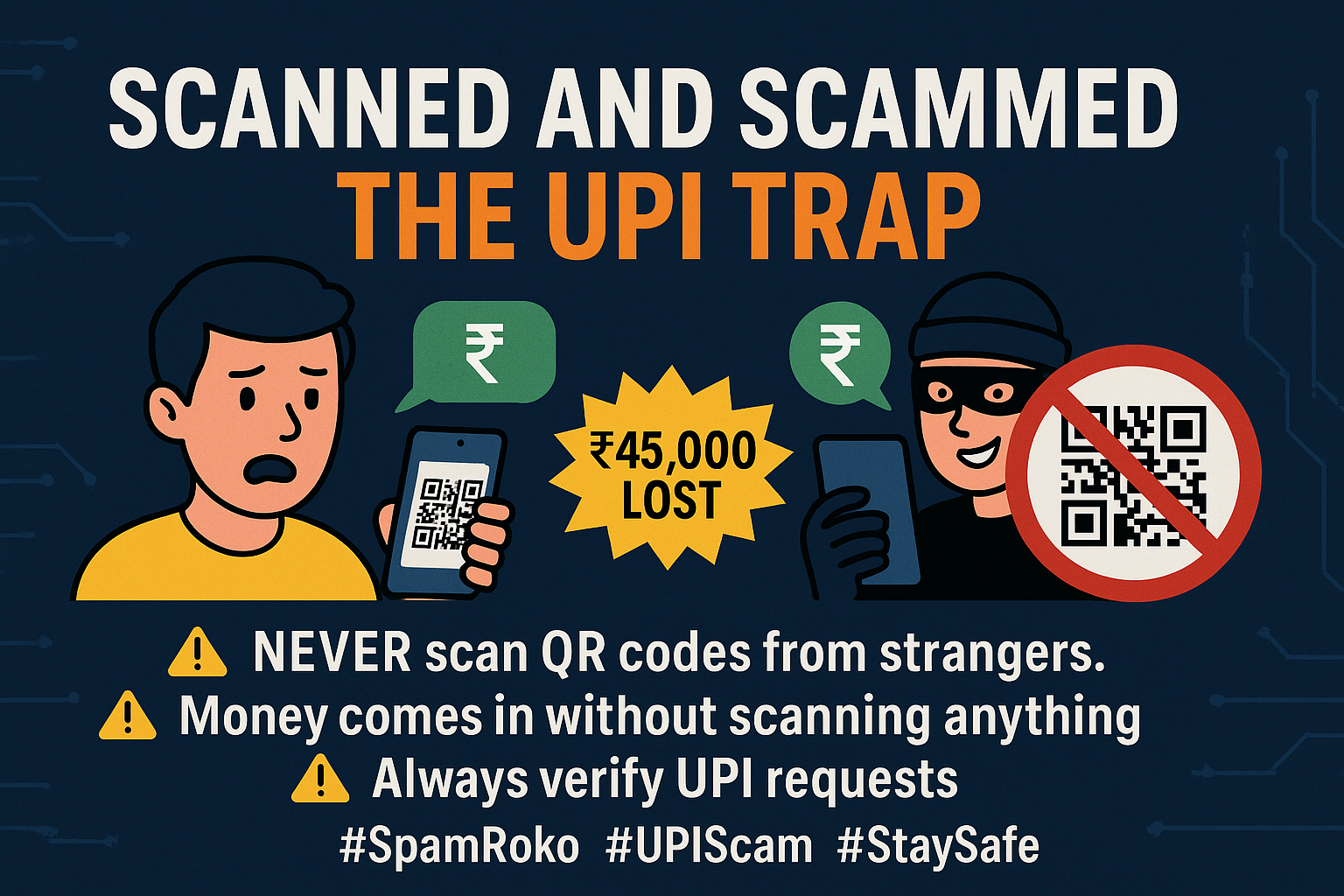

UPI (Unified Payments Interface) scams are a growing digital threat in India. Fraudsters often pose as buyers, sellers, or customer service agents, tricking users into scanning QR codes that actually authorize money to leave their account, not receive it. Many victims think they're accepting payments — only to find their bank accounts drained within seconds.

UPI (Unified Payments Interface) scams are a growing digital threat in India. Fraudsters often pose as buyers, sellers, or customer service agents, tricking users into scanning QR codes that actually authorize money to leave their account, not receive it. Many victims think they're accepting payments — only to find their bank accounts drained within seconds.

UPI (Unified Payments Interface) scams are a growing digital threat in India. Fraudsters often pose as buyers, sellers, or customer service agents, tricking users into scanning QR codes that actually authorize money to leave their account, not receive it. Many victims think they're accepting payments — only to find their bank accounts drained within seconds.

UPI (Unified Payments Interface) scams are a growing digital threat in India. Fraudsters often pose as buyers, sellers, or customer service agents, tricking users into scanning QR codes that actually authorize money to leave their account, not receive it. Many victims think they're accepting payments — only to find their bank accounts drained within seconds.

UPI (Unified Payments Interface) scams are a growing digital threat in India. Fraudsters often pose as buyers, sellers, or customer service agents, tricking users into scanning QR codes that actually authorize money to leave their account, not receive it. Many victims think they're accepting payments — only to find their bank accounts drained within seconds.

UPI (Unified Payments Interface) scams are a growing digital threat in India. Fraudsters often pose as buyers, sellers, or customer service agents, tricking users into scanning QR codes that actually authorize money to leave their account, not receive it. Many victims think they're accepting payments — only to find their bank accounts drained within seconds.

UPI (Unified Payments Interface) scams are a growing digital threat in India. Fraudsters often pose as buyers, sellers, or customer service agents, tricking users into scanning QR codes that actually authorize money to leave their account, not receive it. Many victims think they're accepting payments — only to find their bank accounts drained within seconds.

Courier scams are rapidly increasing across India, with victims reporting harrowing calls from fake courier representatives and police officers. These fraudsters falsely claim that illegal items (such as fake passports or narcotics) were found in parcels allegedly addressed to the victim. Under pressure and fear, people are coerced into transferring money — often to “resolve the case” or avoid arrest. This sophisticated scam leverages fear, urgency, and impersonation of authority figures to trap victims.

Courier scams are rapidly increasing across India, with victims reporting harrowing calls from fake courier representatives and police officers. These fraudsters falsely claim that illegal items (such as fake passports or narcotics) were found in parcels allegedly addressed to the victim. Under pressure and fear, people are coerced into transferring money — often to “resolve the case” or avoid arrest. This sophisticated scam leverages fear, urgency, and impersonation of authority figures to trap victims.

Courier scams are rapidly increasing across India, with victims reporting harrowing calls from fake courier representatives and police officers. These fraudsters falsely claim that illegal items (such as fake passports or narcotics) were found in parcels allegedly addressed to the victim. Under pressure and fear, people are coerced into transferring money — often to “resolve the case” or avoid arrest. This sophisticated scam leverages fear, urgency, and impersonation of authority figures to trap victims.

Courier scams are rapidly increasing across India, with victims reporting harrowing calls from fake courier representatives and police officers. These fraudsters falsely claim that illegal items (such as fake passports or narcotics) were found in parcels allegedly addressed to the victim. Under pressure and fear, people are coerced into transferring money — often to “resolve the case” or avoid arrest. This sophisticated scam leverages fear, urgency, and impersonation of authority figures to trap victims.

Courier scams are rapidly increasing across India, with victims reporting harrowing calls from fake courier representatives and police officers. These fraudsters falsely claim that illegal items (such as fake passports or narcotics) were found in parcels allegedly addressed to the victim. Under pressure and fear, people are coerced into transferring money — often to “resolve the case” or avoid arrest. This sophisticated scam leverages fear, urgency, and impersonation of authority figures to trap victims.

Pig Butchering Scams are a growing cybercrime trend where fraudsters emotionally manipulate victims into fake investment schemes. By faking romantic interest or friendship, scammers build trust and lure people into investing in fraudulent cryptocurrency platforms, causing massive financial losses.

Pig Butchering Scams are a growing cybercrime trend where fraudsters emotionally manipulate victims into fake investment schemes. By faking romantic interest or friendship, scammers build trust and lure people into investing in fraudulent cryptocurrency platforms, causing massive financial losses.

QR Code scams, also known as "Quishing," are on the rise across India. These scams involve fake QR codes that lead unsuspecting users to phishing sites or install malware. Learn how to detect and avoid these increasingly common cyber threats.

QR Code scams, also known as "Quishing," are on the rise across India. These scams involve fake QR codes that lead unsuspecting users to phishing sites or install malware. Learn how to detect and avoid these increasingly common cyber threats.

QR Code scams, also known as "Quishing," are on the rise across India. These scams involve fake QR codes that lead unsuspecting users to phishing sites or install malware. Learn how to detect and avoid these increasingly common cyber threats.

QR Code scams, also known as "Quishing," are on the rise across India. These scams involve fake QR codes that lead unsuspecting users to phishing sites or install malware. Learn how to detect and avoid these increasingly common cyber threats.

Investment scams — especially in crypto — are increasing rapidly in India. Scammers lure victims with false promises of high returns through fake platforms. Experts warn that losses may exceed ₹20,000 crore in 2025.

Investment scams — especially in crypto — are increasing rapidly in India. Scammers lure victims with false promises of high returns through fake platforms. Experts warn that losses may exceed ₹20,000 crore in 2025.

Investment scams — especially in crypto — are increasing rapidly in India. Scammers lure victims with false promises of high returns through fake platforms. Experts warn that losses may exceed ₹20,000 crore in 2025.

Pig Butchering Scams are a growing cybercrime trend where fraudsters emotionally manipulate victims into fake investment schemes. By faking romantic interest or friendship, scammers build trust and lure people into investing in fraudulent cryptocurrency platforms, causing massive financial losses.

QR Code scams, also known as "Quishing," are on the rise across India. These scams involve fake QR codes that lead unsuspecting users to phishing sites or install malware. Learn how to detect and avoid these increasingly common cyber threats.

QR Code scams, also known as "Quishing," are on the rise across India. These scams involve fake QR codes that lead unsuspecting users to phishing sites or install malware. Learn how to detect and avoid these increasingly common cyber threats.

Investment scams — especially in crypto — are increasing rapidly in India. Scammers lure victims with false promises of high returns through fake platforms. Experts warn that losses may exceed ₹20,000 crore in 2025.

Account Takeover (ATO) Fraud is a rising threat in India, where scammers use stolen login details to hijack user accounts on mobile wallets and payment platforms. These unauthorized access events often result in direct financial theft and identity misuse.

Account Takeover (ATO) Fraud is a rising threat in India, where scammers use stolen login details to hijack user accounts on mobile wallets and payment platforms. These unauthorized access events often result in direct financial theft and identity misuse.

Account Takeover (ATO) Fraud is a rising threat in India, where scammers use stolen login details to hijack user accounts on mobile wallets and payment platforms. These unauthorized access events often result in direct financial theft and identity misuse.

Account Takeover (ATO) Fraud is a rising threat in India, where scammers use stolen login details to hijack user accounts on mobile wallets and payment platforms. These unauthorized access events often result in direct financial theft and identity misuse.

Account Takeover (ATO) Fraud is a rising threat in India, where scammers use stolen login details to hijack user accounts on mobile wallets and payment platforms. These unauthorized access events often result in direct financial theft and identity misuse.

Account Takeover (ATO) Fraud is a rising threat in India, where scammers use stolen login details to hijack user accounts on mobile wallets and payment platforms. These unauthorized access events often result in direct financial theft and identity misuse.

Account Takeover (ATO) Fraud is a rising threat in India, where scammers use stolen login details to hijack user accounts on mobile wallets and payment platforms. These unauthorized access events often result in direct financial theft and identity misuse.

Pig Butchering Scams are a growing cybercrime trend where fraudsters emotionally manipulate victims into fake investment schemes. By faking romantic interest or friendship, scammers build trust and lure people into investing in fraudulent cryptocurrency platforms, causing massive financial losses.

Pig Butchering Scams are a growing cybercrime trend where fraudsters emotionally manipulate victims into fake investment schemes. By faking romantic interest or friendship, scammers build trust and lure people into investing in fraudulent cryptocurrency platforms, causing massive financial losses.

Pig Butchering Scams are a growing cybercrime trend where fraudsters emotionally manipulate victims into fake investment schemes. By faking romantic interest or friendship, scammers build trust and lure people into investing in fraudulent cryptocurrency platforms, causing massive financial losses.

Pig Butchering Scams are a growing cybercrime trend where fraudsters emotionally manipulate victims into fake investment schemes. By faking romantic interest or friendship, scammers build trust and lure people into investing in fraudulent cryptocurrency platforms, causing massive financial losses.